The Chinese smartphone comes with a high-end processor, a 120 Hz screen and 4 rear cameras.

The finance theme it is something that worries all people; even more when you need go ahead and stick to a budget. However, currently we can get some applications that offer us advice for learn to save and manage our money efficiently.

These 8 apps that we offer you are fabulous classifying expenses by categories, creating objectives, promoting savings and many other advantages.

The best 8 applications to learn how to save with your mobile

Best 8 apps to learn how to save with your mobile

- Spendee-Budget, Expense Control

- Challenge 52 weeks to save

- Money Manager, Expense Tracker

- Qapital: Find Money Happiness

- Fintonic / Personal Finance and Financing

- Piggo

- COINSCRAP: Save more by spending

- Wallet – Manage your money

All these apps will allow you to carry a control of your finances, know the money that enters and leaves your portfolio, establish budgets and goals for save money in the short, medium and long term.

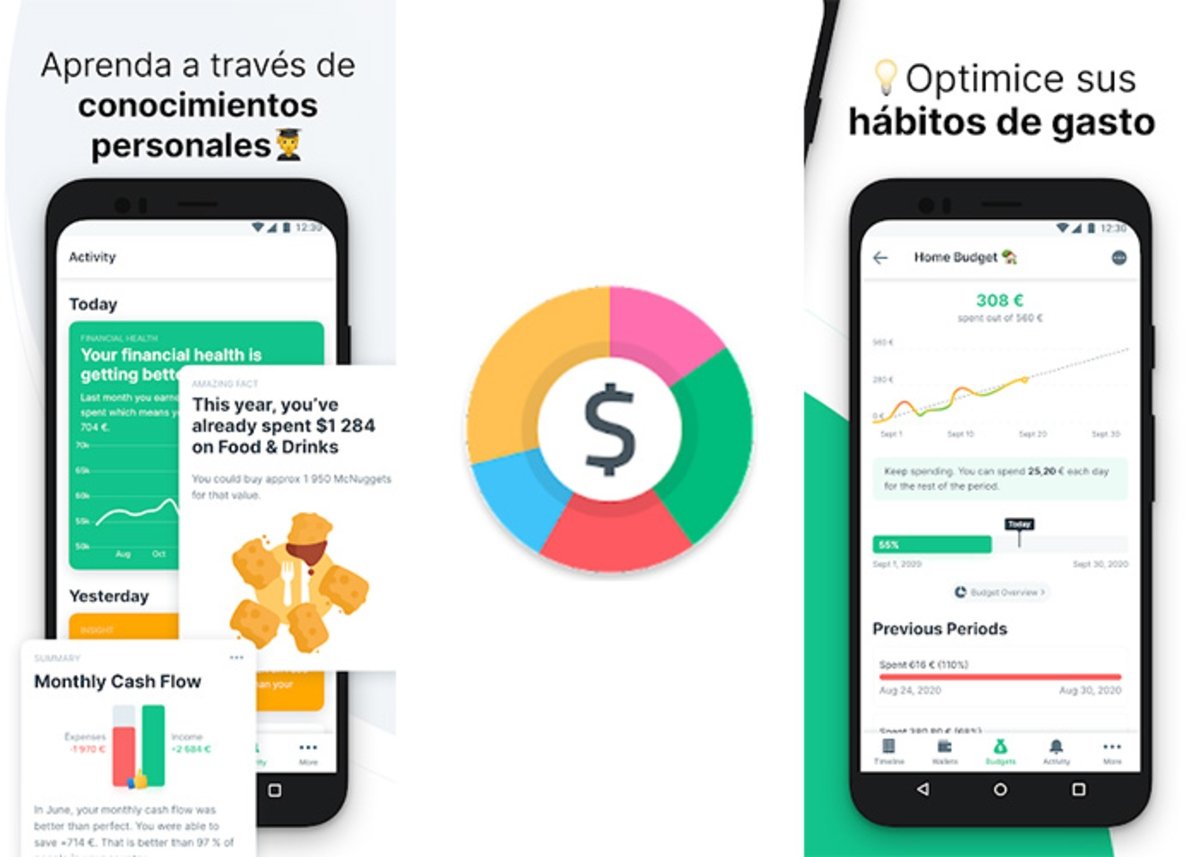

Spendee-Budget, Expense Control

Optimize your spending habits

Donation is an app that allows you to establish a connection between your online banking and wallets. It is a very complete platform where you can do everything from one place.

In addition, you will be able to see your finances classified by categories, presented with select graphics and simple infographics. He is also able to offer effective advice to achieve your financial success and stay informed about the money that enters and leaves your account.

And if that was not enough, Donation sends notifications about your movements, advises you on how to create budgets, organize bank accounts, share finances with other people, label transactions, among others.

Its design is extremely intuitive and offers Keep data sync for the security of your private data and a dark road that favors your vision.

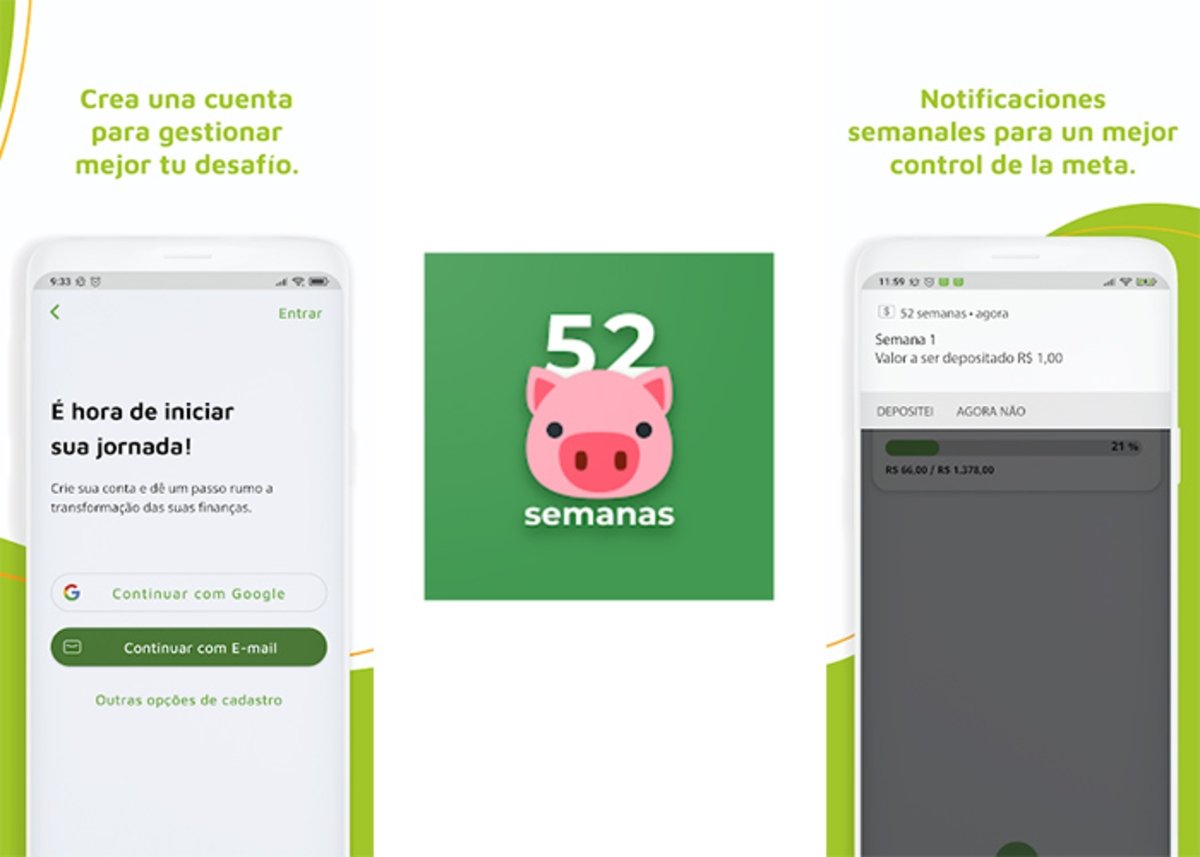

Challenge 52 weeks to save

Create an account to better manage your challenge

As its name says, this application poses a saving challenge; The idea is save weekly a small amount that will gradually increase.

For example, if you propose save during the 52 weeks or 1 consecutive year and you start saving € 2 the first week of January, and you save € 3 the first week, $ 4 the second, € 5 the third and so on, in the last week of December you will have € 2,756 saved in your account bank.

The idea is save money progressively, and although we know that the saving effort will be greater as the weeks go by, this application is a good alternative for learn to save and, above all, have money for December holidays or holidays.

Money Manager, Expense Tracker

Manage your money in one place

An application that stands out for great variety of categories created for control expenses and finances. So much so, that it is possible to differentiate, for example, the types of food that you have bought and compare if you have spent more money on junk food than on vegetables during the month.

The app performs daily reminders to record income and expenses, offers control strategies, capital investment, savings and expense planning, exports data in CSV and is free. Without a doubt, it is a smart platform that gives you the opportunity to achieve your financial goals, both individually and as a couple.

In the same way, create effective money habits adjusting expenses, has an FDIC insured checking account with immediate access to balances, free transfers (with Savings Sweet), Visa debit and deposit card straight to checks, bill pay and more.

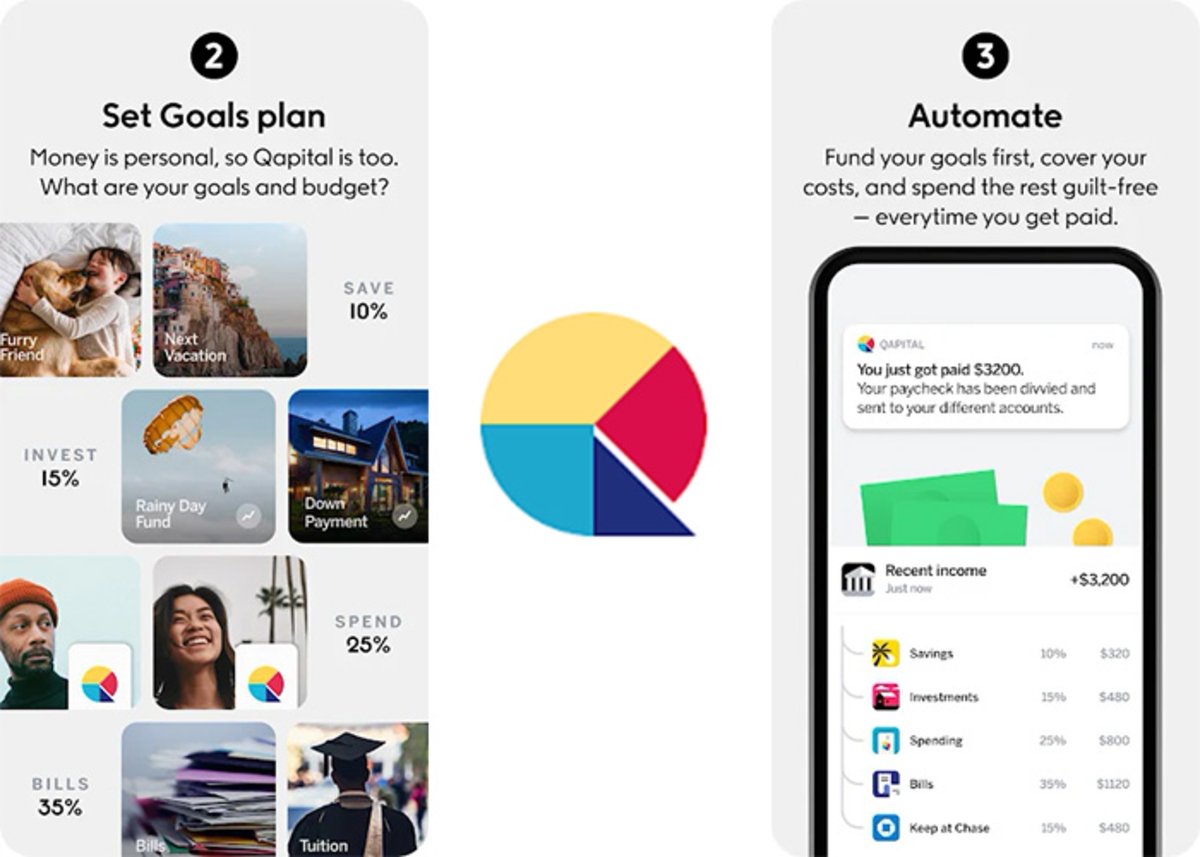

Qapital: Find Money Happiness

Stop budgeting and start capitalizing

Qapital is a smart app so that you achieve your financial goals, both individually and as a couple, offering control strategies, capital investment, savings and expense planning. Through Payday Division, fragment your bills, paychecks and unforeseen expenses into short and long-term plans.

Likewise, create effective money habits adjusting expenses and comes with an FDIC-insured checking account with immediate access to balances, free transfers (with Savings Sweet), Visa debit card and direct deposit to checks and bill payment.

Fintonic / Personal Finance and Financing

Your money under control with alerts and notifications

Fintonic is one of the best apps to learn how to save and keep control of your money. It was awarded the Google award As the best finance app, it has financing plans and discounts on electricity, mobile phones, insurance.

The app also alerts you to duplicate charges, Bank fees, insurance expiration and others. By means of the tool FinScore you’ll learn effective saving methods and you will get loans and insurance in more than 50 banks.

As if that were not enough, the app also group your movements by categories and your data will be protected by the RGPD (General Data Protection Regulation) of Europe.

Piggo

Piggo: choose how you want to save

Piggo is a Mexican and free application with options and information for learn to save from your mobile. It belongs to Grupo Bursátil Mexicano (GBM) SA de CV Finanzas, it does not include mandatory terms or penalties and it is totally digital.

Keep your money safe at GBM and get extra money with your performance. Set objectives and goals to organize your money and you can have a good control of your finances.

It is very easy to use and when you download the app, you must establish your goals and decide how to save your money without the need to travel to banks.

COINSCRAP: Save more by spending

With COINS you can choose the savings plan with rules that best suit your needs and start saving; the app round your expenses to the nearest euro when making purchases and the rest is saved in your digital piggy bank.

The app also offers security so you can invest with confidence and gives you a savings plan for your retirement. Also, your data has AES 256-bit security encryption, becoming one of the safest options.

Among the plans that Coinscrap offers, the following stand out: I stay at home, roundings, periodic monthly or annual contribution, payroll, hot savings, no caffeine, equipment and smoker, all of them leaving a specific contribution.

Wallet – Manage your money

Keep the control of your expenses and budget and actively plan to achieve your goals through banks, currencies and financial institutions. The app performs real-time tracking of your expenses and keeps you informed about your movements.

The app has Automatic Updates, categorized expenses, flexible budgets, easy graphs and reports on accounts, credit and debit cards, cash, cloud sync, templates, labels, notices, Security PIN and much more.

If you liked this article, do not hesitate to take a look at the best applications to earn money with your mobile, or better yet, learn to send and receive money with Bizum at ING.

Related topics: Applications, Free apps

Follow us on Instagram @ andro4allcom

Join our Telegram channel @ Andro4all

Follow us on Facebook andro4all

Introvert. Beer guru. Communicator. Travel fanatic. Web advocate. Certified alcohol geek. Tv buff. Subtly charming internet aficionado.