André Tiedje in the weekly pass: All US Index Day Trader webinars are now available on the weekly pass that automatically expires. Find out more now – click me

Dear users,

It’s really hot outside right now, and it’s going to be particularly cheap in here.

We offer you a 30% discount on all premium services provided by our Elliott Wave expert André Tiedje* until June 26.

Use the code Tiedje22 by:

Enter the code Tiedje22 in the last step of the order.

We wish you a lot of fun with your summer discount

Your Guidants & Godmodetrader team

*The discount refers to the first billing period of the three-month subscription to André Tiedjes Elliot Wave Analysis, André Tiedjes Elliot Wave Trading, André Tiedjes Cryptonator and ICE Revelator. The discount is applied once, cannot be applied to existing subscriptions and cannot be combined with other promotions. The discount is always granted on the final amount of the invoice. In the case of an upgrade, this is the amount remaining after the respective upgrade has been settled. The coupon code is valid until June 26, 2022 inclusive.

BitcoinBTC/USD

Elliott wave analysis

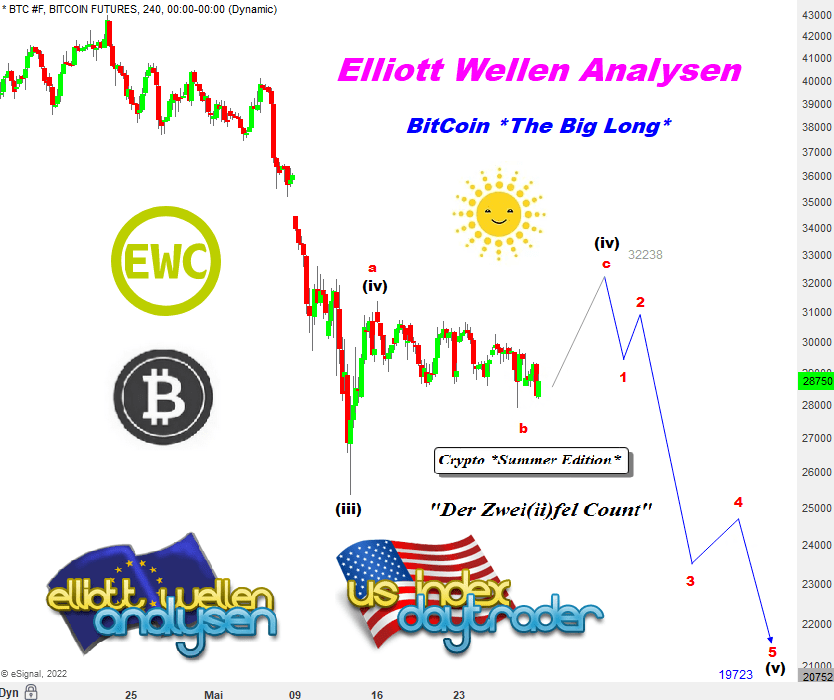

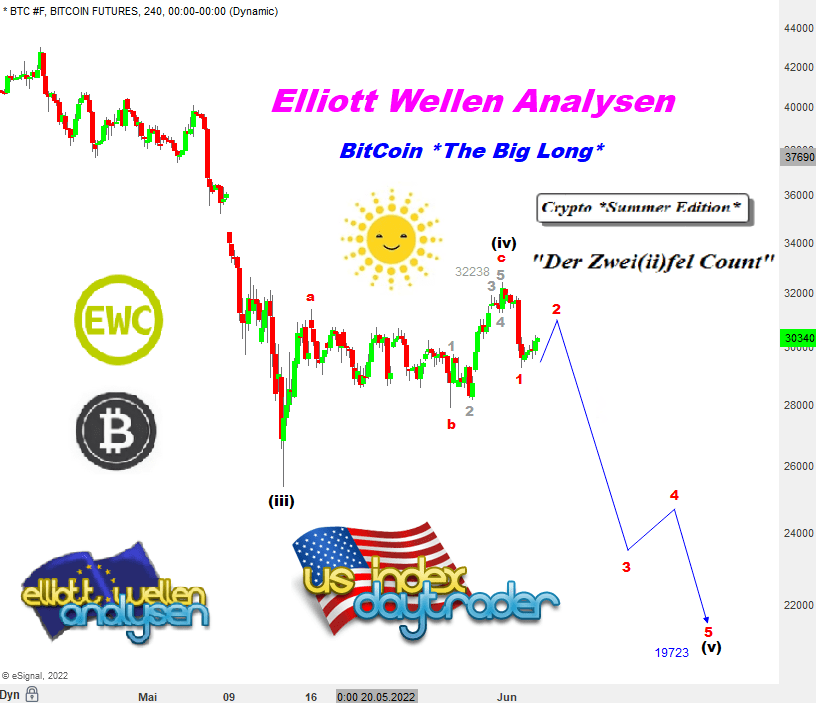

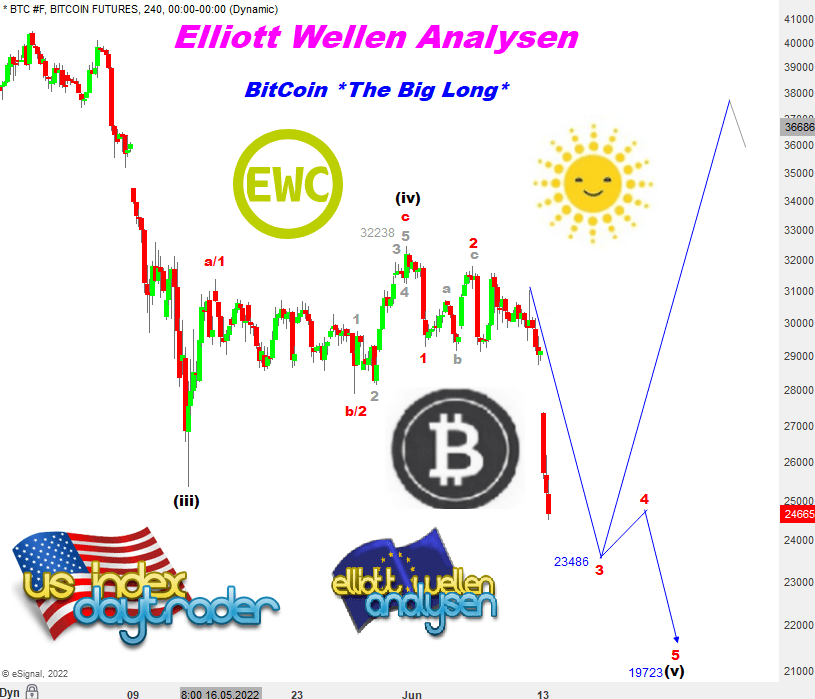

Repeat: The Waves (iii) Y (v) they are analyzed in more detail in the following 4-hour chart. if the wave (iii) expand up, then a correction mark is included 32238 AMERICAN DOLLAR. From the area would then be the downward momentum 1-2-3-4-5 wave (v) to create. A harmonious goal is included. 19723 USD, but you are also welcome to form a little less than USD 25,000.

Course development on the 4-hour chart (log candlestick chart display/ 1 candle = 4 hours)

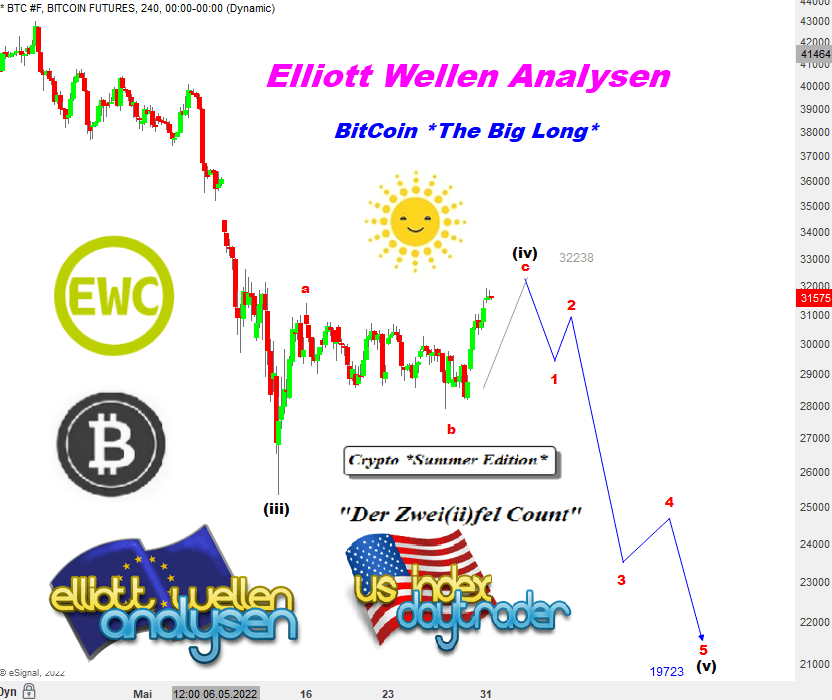

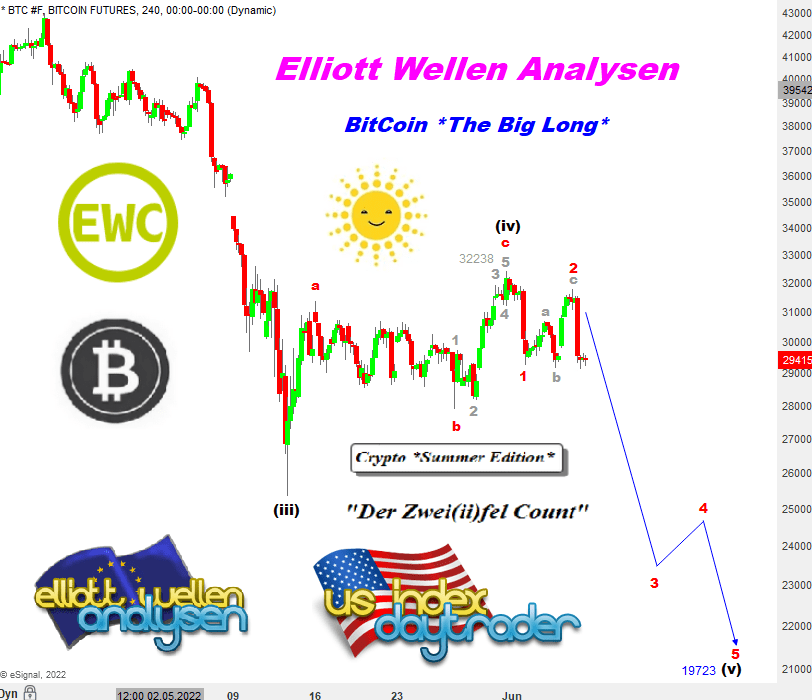

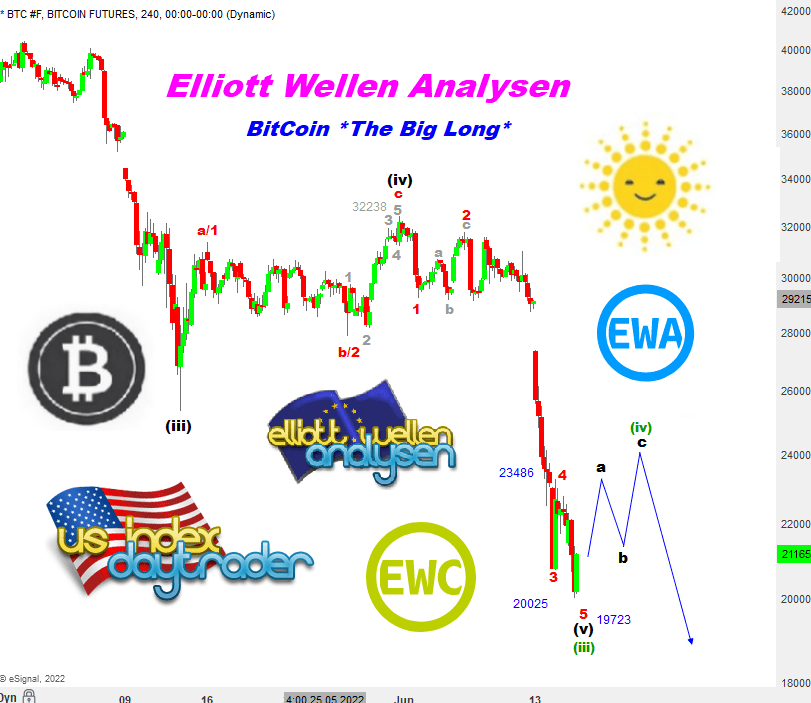

Repeat: For the wave (iii) a correction mark is included 32238 USD ready, so far it has been 31945 USD. The downward momentum would then start from this area. 1-2-3-4-5 wave (v) develop. A harmonious goal is included. 19723 USD, but you are also welcome to form a little less than USD 25,000.

Course development on the 4-hour chart (log candlestick chart display/ 1 candle = 4 hours)

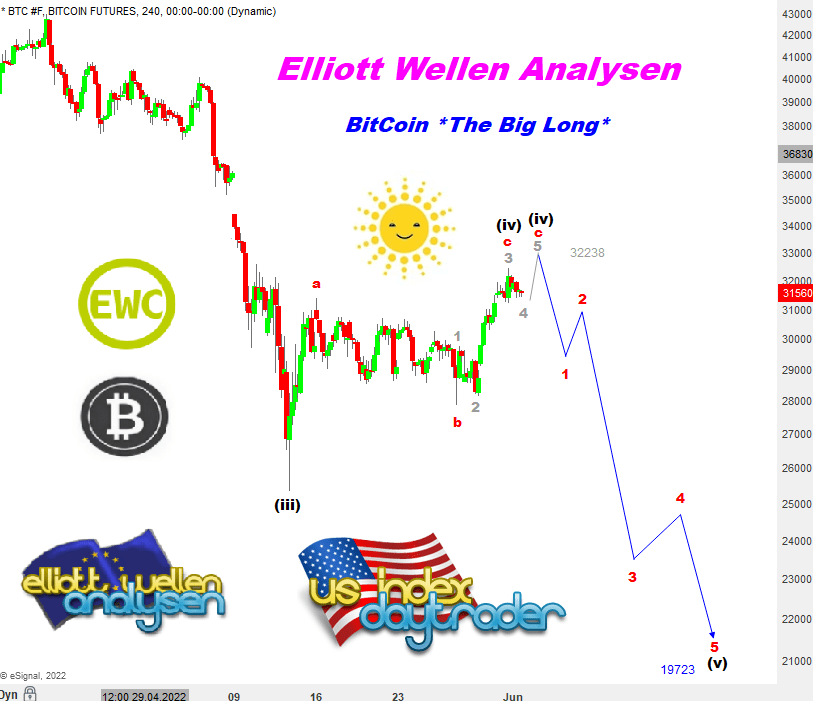

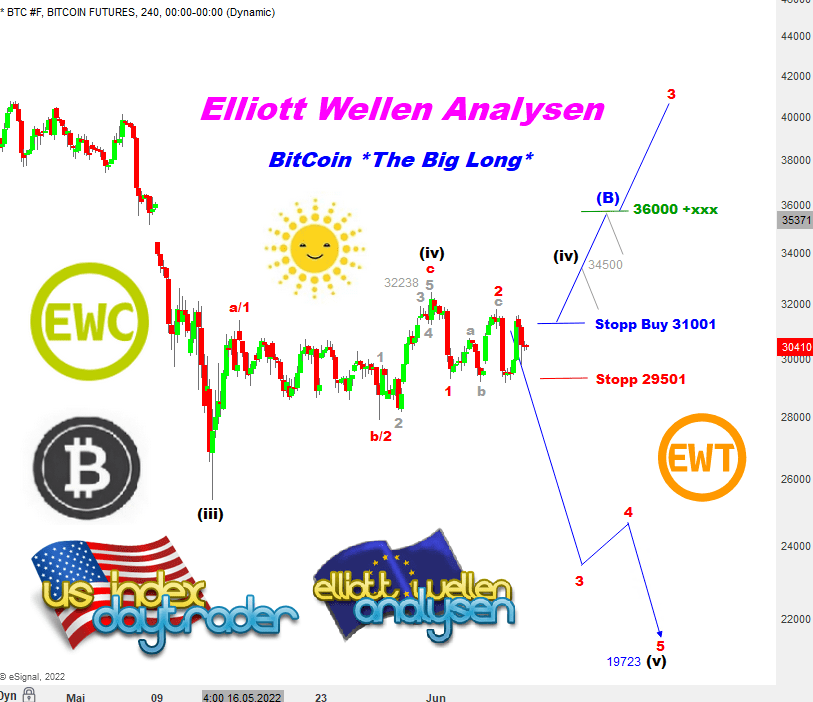

Summary: We are talking about very thin ice here. The last high becomes a wave 3 the C wave (iii) recognized and there could be another high like a wave 5 the C wave (iii) continue.

Course development on the 4-hour chart (log candlestick chart display/ 1 candle = 4 hours)

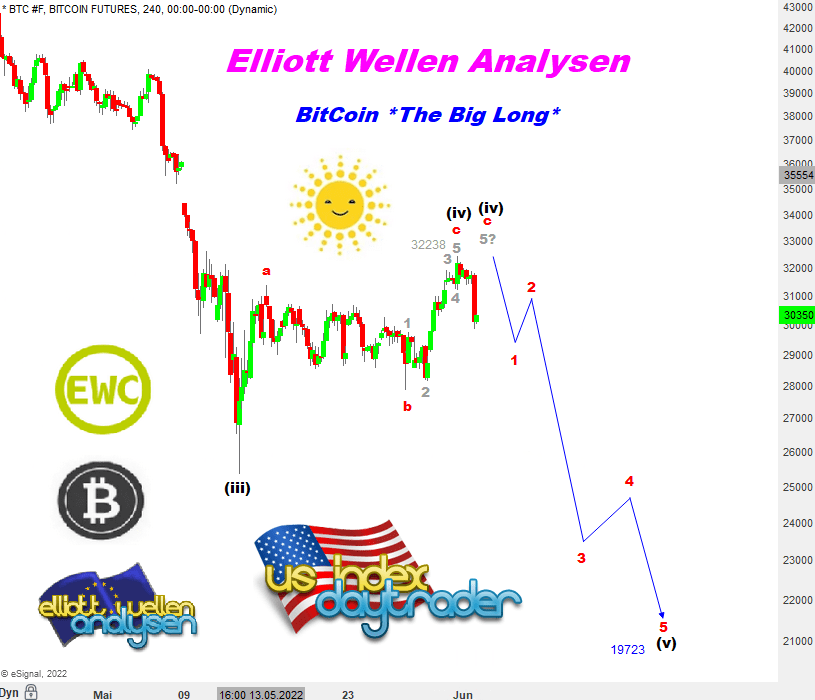

Course development on the 4-hour chart (log candlestick chart display/ 1 candle = 4 hours)

inside the wave two BitCoin goes up, he told himself.

Course development on the 4-hour chart (log candlestick chart display/ 1 candle = 4 hours)

Riding the wave of recovery twocoming out of the waves ABC created, is the continuation of the downward momentum 1-2-3-4-5 in the plane

Course development on the 4-hour chart (log candlestick chart display/ 1 candle = 4 hours)

I repeat: Unfortunately, the probability of a wave (iii) either (b) slightly higher, so that more minima occur later, or directly. However, there is a chance to secure the brave long trade for the first time.

Course development on the 4-hour chart (log candlestick chart display/ 1 candle = 4 hours)

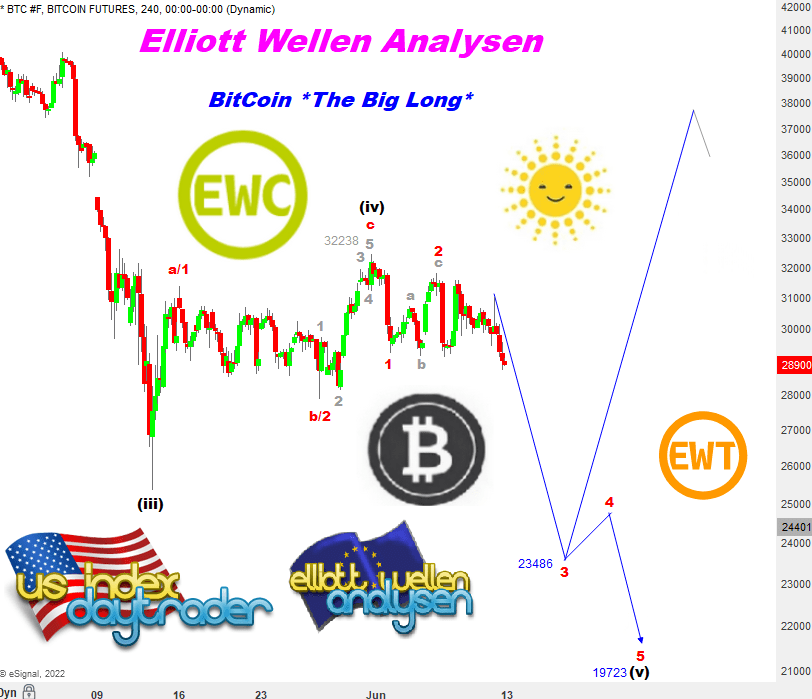

I repeat: a new low for the year would be at the top of the wish list. If this happens, then it makes sense to do an intensive ground search from $23486.

Course development on the 4-hour chart (log candlestick chart display/ 1 candle = 4 hours)

I repeat: the bears celebrate and push BitCoin to a new yearly low.

Course development on the 4-hour chart (log candlestick chart display/ 1 candle = 4 hours)

Wave 3 could develop and cause more casualties, maybe the wave is already there 5 ongoing, according to one of the previous analyses.

Conclusion:

It is an excerpt from the new Cryptonator, the chart under analysis is from 06/14/2022. Instead of the weekly chart, here he goes into detail, or rather to the point. 🙂

I wish you every success in your decisions and do not get into difficulties, this inevitably leads to wrong decisions.

André Tiedje – Elliott Wave Expert, Technical Analyst and Trader at GodmodeTrader.de

I wish you every success in your decisions and do not get into difficulties, this inevitably leads to wrong decisions.

Course development on the 4-hour chart (log candlestick chart display/ 1 candle = 4 hours)

Disclosure of Potential Conflicts of Interest: The author is invested in the discussed or base stocks at the time of publication of this analysis.

I am responsible for 3 business services. In these you can immediately see the commercial preparations and follow and play them if you are interested.

Elliott wave trading with André Tiedje

André Tiedje’s Elliott Wave Analysis

The Elliott Wave book is available here: Click here for Simplified Elliott Waves

Did my analysis convince you? So start trading JFD right away. There you can trade all the major markets with more than 1500 instruments in eight asset classes. Simply open an account with JFD and replicate my analysis with discount benefits.